At Realty Trust Fund, we leverage our strategy, experience and relationships to bring you investment opportunities.

We give you access to a broad assortment of real estate investment opportunities with minimums as low as $10,000, so you can build a diversified portfolio.

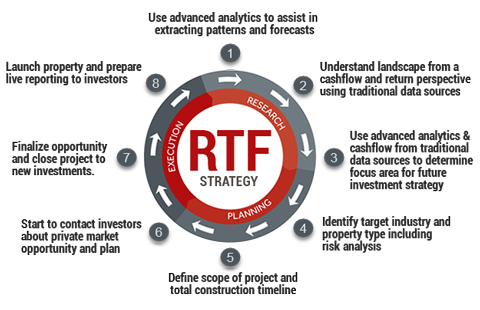

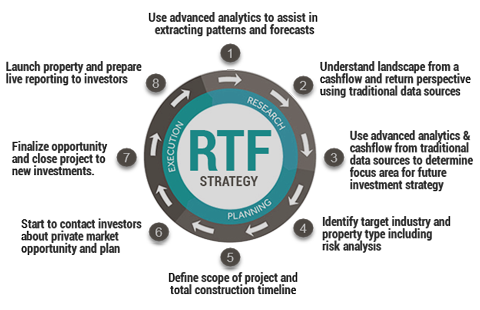

Our strategy is to focus on distinctive projects based upon a pre-defined set of metrics and core characteristics in 37 discrete metropolitan areas within the continental United States. We have significant 'real-world' experience in each of these cities. We do not try to be all things to all people.

In addition to our experience in each of these locales, we used a fact-based set of metrics, such as job creation, wage gains, technological development, industry mix, colleges and universities, health care, natural and man-made infrastructure, etc. in selecting these specific geographic areas.

Connect with Us Online!

Ask Questions or Follow UsUnique & Proprietary

Proprietary Strategy

We do not randomly select projects to invest. We have a very unique set of characteristics and metrics we use to determine MSAs and sub-markets and then present opportunities within those areas.

Exclusive Access

The deals presented on this website are typically not widely marketed. Although they have been a thorough vetting process, we always encourage you to do your own vetting.

Active Transparency

Once you invest in a project, you will have a direct relationship with the real estate General Partner/Developer and we encourage active and full transparency on all financial and other matters.

Live Property

Investment Webinar!

Sign Up Today!

Sign up for one of our MONTHLY investment opportunity webinars to discuss the investment process and any current or future opportunities.

Webinar Topics

- Targeted Cash Return

- Target Internal Rate of Return

- Asset Profile Including Risk

- Occupation Rate

- Minimum Investment

- Investment Strategy

- Average Lease Term